Life Insurance in and around Saint Louis

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

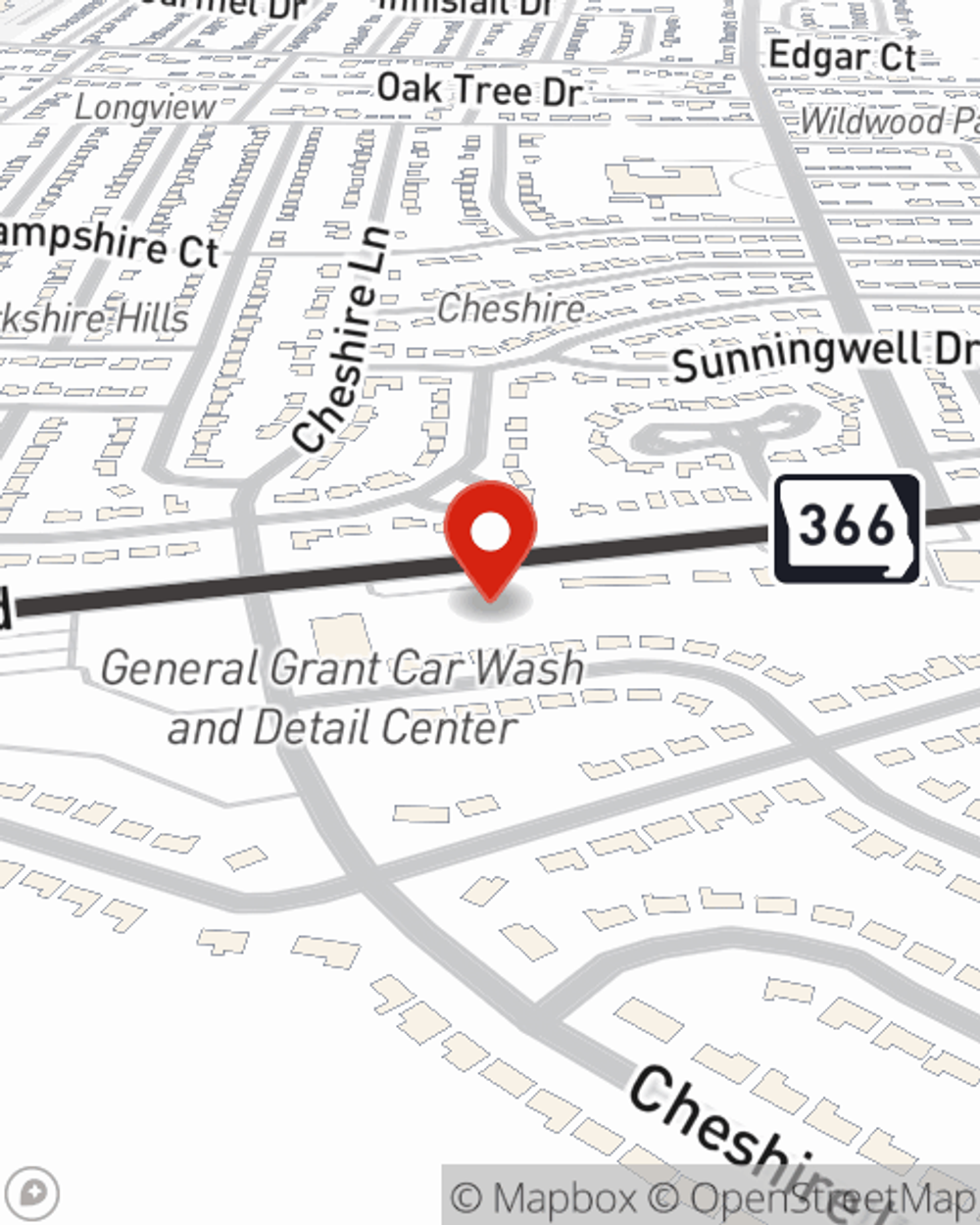

- Webster Groves, MO

- Crestwood, MO

- Affton, MO

- Kirkwood, MO

- Chesterfield, MO

- St. Peters, MO

- St. Charles, MO

- Wentzville, MO

- Illinois

- Arkansas

- Kansas

- Florissant, MO

- Clayton, MO

- Kansas City, MO

- Brentwood, MO

- Columbia, MO

- Washington, MO

- Columbia, IL

- Chicago, IL

- Arnold, MO

- South County, MO

- West County, MO

- Sunset Hills, MO

- South City, MO

Protect Those You Love Most

No one likes to fixate on death. But taking the time now to arrange a life insurance policy with State Farm is a way to show care to your loved ones if you die.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

The beneficiary designated in your Life insurance policy can help meet important needs for your family when you pass away. The death benefit can help with things such as home repair costs, retirement contributions or ongoing expenses. With State Farm, you can rely on us to be there when it's needed most, while also providing sensitive, responsible service.

If you're looking for reliable coverage and considerate service, you're in the right place. Reach out to State Farm agent Melissa Carlton today to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Melissa at (314) 842-2422 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Melissa Carlton

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.