Business Insurance in and around Saint Louis

Calling all small business owners of Saint Louis!

Helping insure small businesses since 1935

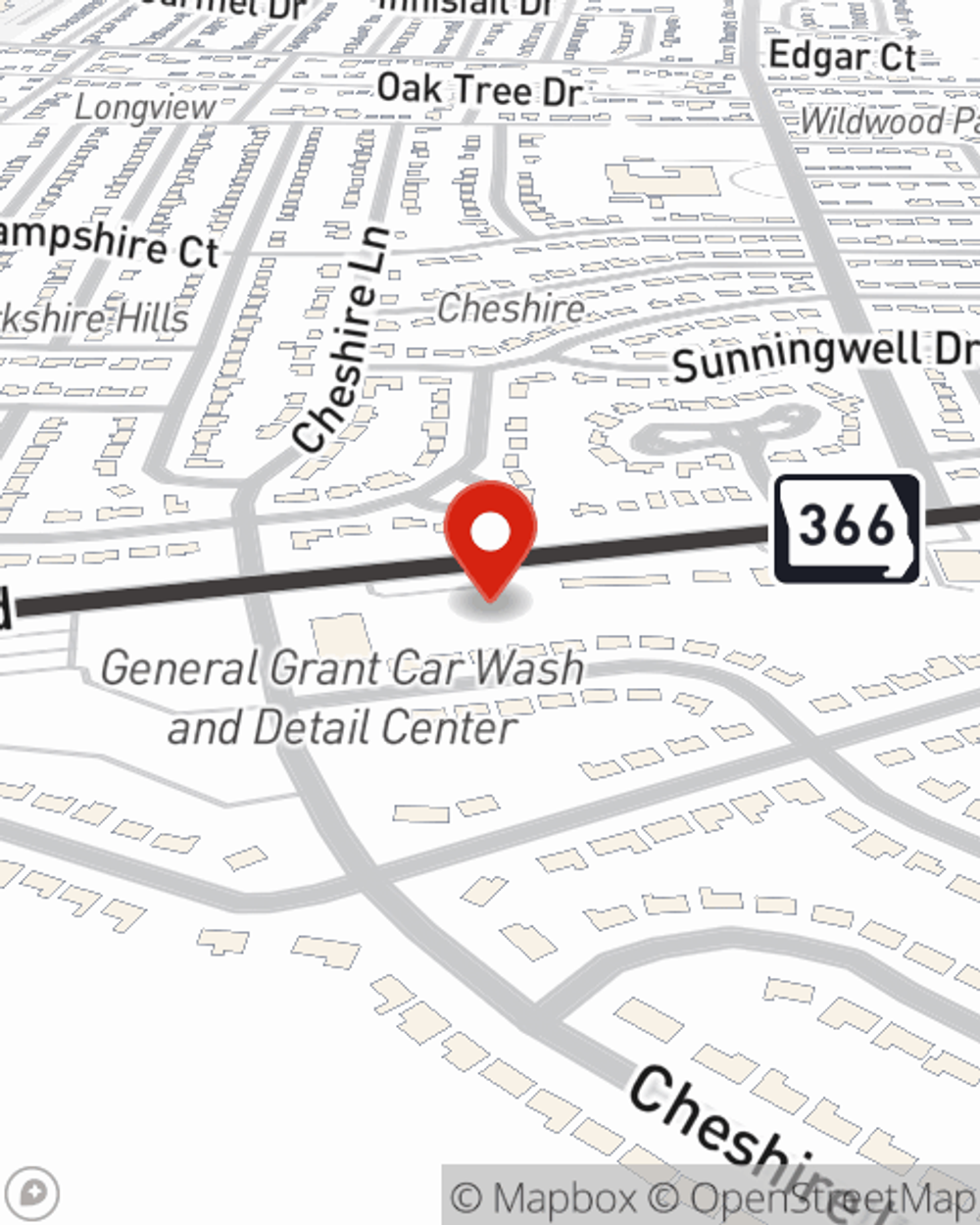

- Webster Groves, MO

- Crestwood, MO

- Affton, MO

- Kirkwood, MO

- Chesterfield, MO

- St. Peters, MO

- St. Charles, MO

- Wentzville, MO

- Illinois

- Arkansas

- Kansas

- Florissant, MO

- Clayton, MO

- Kansas City, MO

- Brentwood, MO

- Columbia, MO

- Washington, MO

- Columbia, IL

- Chicago, IL

- Arnold, MO

- South County, MO

- West County, MO

- Sunset Hills, MO

- South City, MO

Help Protect Your Business With State Farm.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Melissa Carlton. Melissa Carlton understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Calling all small business owners of Saint Louis!

Helping insure small businesses since 1935

Insurance Designed For Small Business

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a dog groomer or a photographer or you own an auto parts shop or a shoe repair shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Melissa Carlton. Melissa Carlton is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

Get in touch with the exceptional team at agent Melissa Carlton's office to uncover the options that may be right for you and your small business.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Melissa Carlton

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.